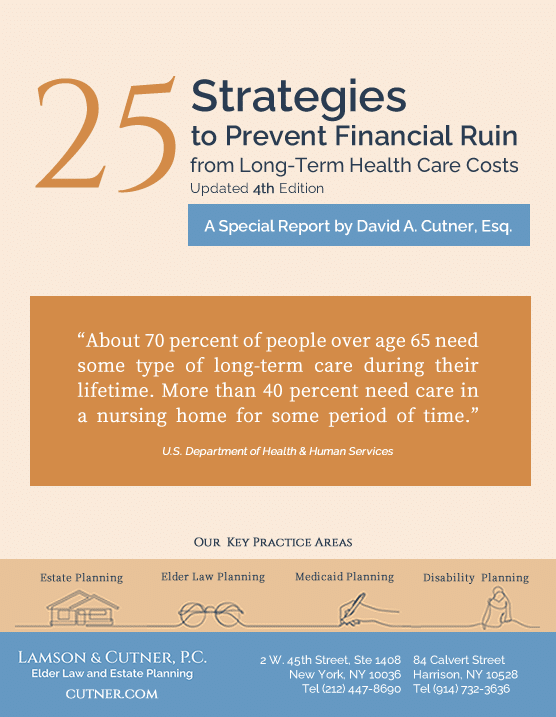

This is Strategy #19 from Lamson & Cutner’s publication, “25 Strategies to Prevent Financial Ruin from Long-Term Health Care Costs.” Click here to see the other strategies.

When planning involves a married couple, and one of the spouses needs or will soon need long-term care, it’s critical to understand a concept called “Spousal Refusal.”

Under New York law, each spouse has an obligation of financial support for the other. This allows Medicaid to require the well or “community” spouse to contribute to the cost of care from available assets. In New York however, Medicaid cannot legally deny benefits or halt the application process because a husband or wife refuses to provide monetarily for his or her ill spouse. This is why, from an Elder Law planning perspective, a legal document referred to as a “Spousal Refusal” is employed.

Signing a Spousal Refusal and refusing to contribute to your spouse’s care permits the application process to continue, so that your wife or husband can qualify for benefits. At the same time, it also keeps your assets intact, so that strategies can be initiated to protect them.

Signing a Spousal Refusal doesn’t mean you’re automatically exempt from economic support of your husband or wife. It just means Medicaid can’t deny benefits to your spouse because you’ve refused support. In these cases, Medicaid can and usually will pursue legal remedies to enforce your obligation and recoup the cost of the benefits they provided, to the extent possible.

It is important to note, however, that Medicaid will only ask for reimbursement of their costs. Medicaid costs are already well below what people pay privately – so the reimbursement would already be at a significant discount. It is also possible to negotiate with Medicaid in most of these instances, since they’d rather come to a reasonable settlement than initiate legal proceedings. Needless to say, in negotiations with a government agency, you are better off being represented by experienced Elder Law legal professionals than going it alone.

visit our key practice areas